🛠 This portfolio is a work in progress 🧰

— an AI based expense management tool

Summary

Joining as the first designer at Fyle is an experience I’ll always cherish. I had the opportunity to learn and grow alongside the company, contributing to their journey from 0 to 1 and beyond. Starting from a simple add-on, we expanded the team and design scope, ultimately creating a comprehensive platform for managing expenses, integrating credit cards, handling taxes, and leveraging AI for audits.

Impact

Amid parallel research and design efforts across the website, marketing, and product, we achieved slow but steady growth. In the first 1.5 years, we scaled revenue from $40k to $1M. By continuously pivoting and iterating based on customer feedback, we reached the $1M mark and identified the 20% of customers who would drive 80% of our revenue. Focusing our design efforts on this key segment helped accelerate revenue growth even further.

Details

Evolving Solutions with Customer Insights

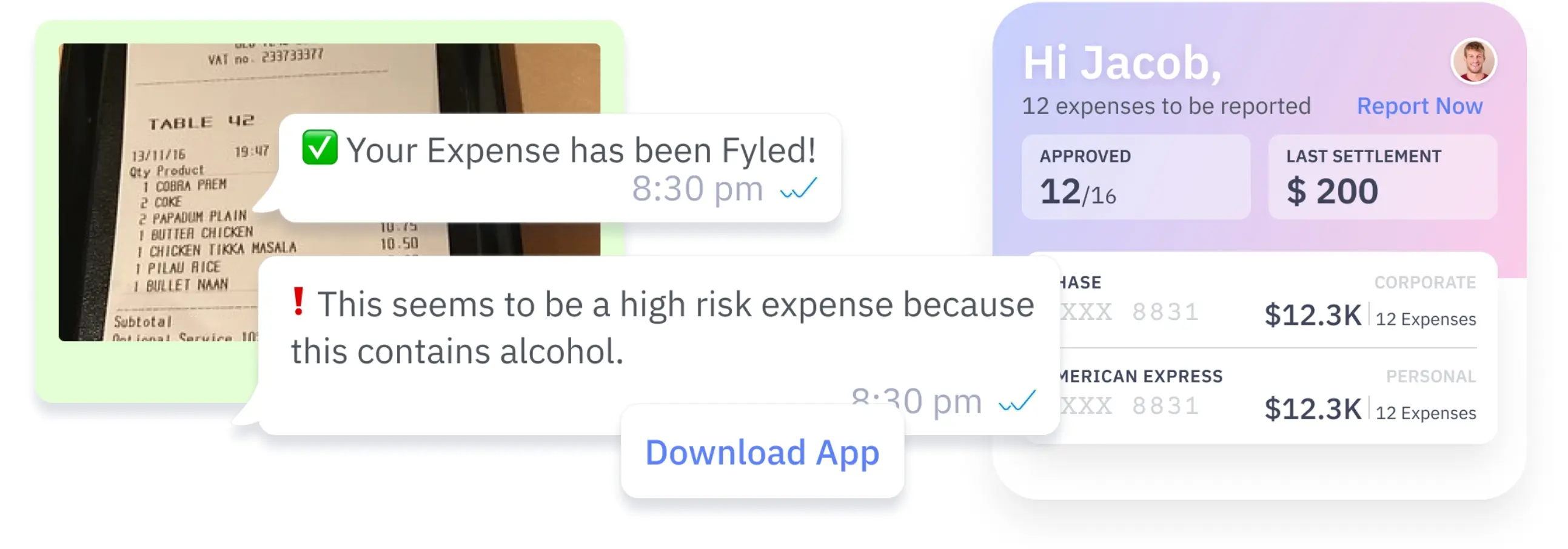

Initially, we approached the problem with a conventional web and mobile app solution. However, through extensive research and customer feedback, we realized users wanted to spend less time filing expenses. In response, we automated the process as much as possible and enabled users to report expenses and request reimbursements directly through WhatsApp.

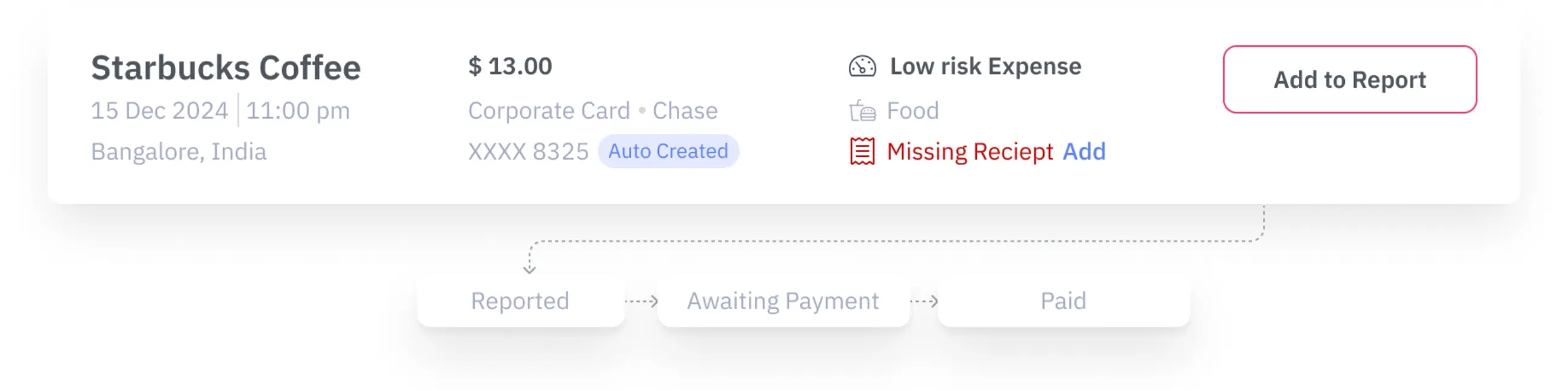

Auto-creation and Reporting for corporate card expenses

For some corporate card transactions we get the receipts online or from the gallery from which we automatically add to the expense. For the ones that do not have a receipt but needs one, we send a reminder to the team.

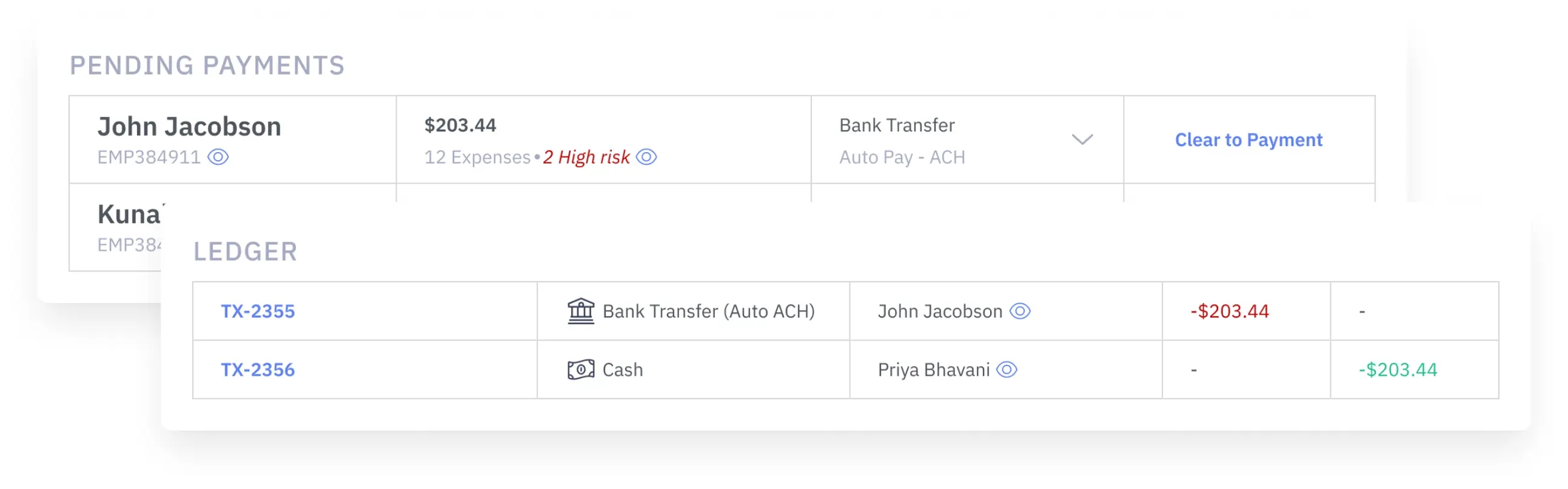

Auto-Reconciliation is a blessing for accountants

To address the needs of our other user group—accountants and auditors—we integrated with major global banks and financial services. Coupled with AI-driven auditing and risk assessment algorithms, this allowed us to automate reconciliation and settle reimbursements with minimal human intervention, freeing up valuable time for everyone involved.

More research, more personas, more business

In the first year, we pivoted solutions and designs three times to align with the diverse needs of different accounting practices and business types. This iterative approach helped mature the product and design, ultimately attracting a broader and more diverse set of businesses.

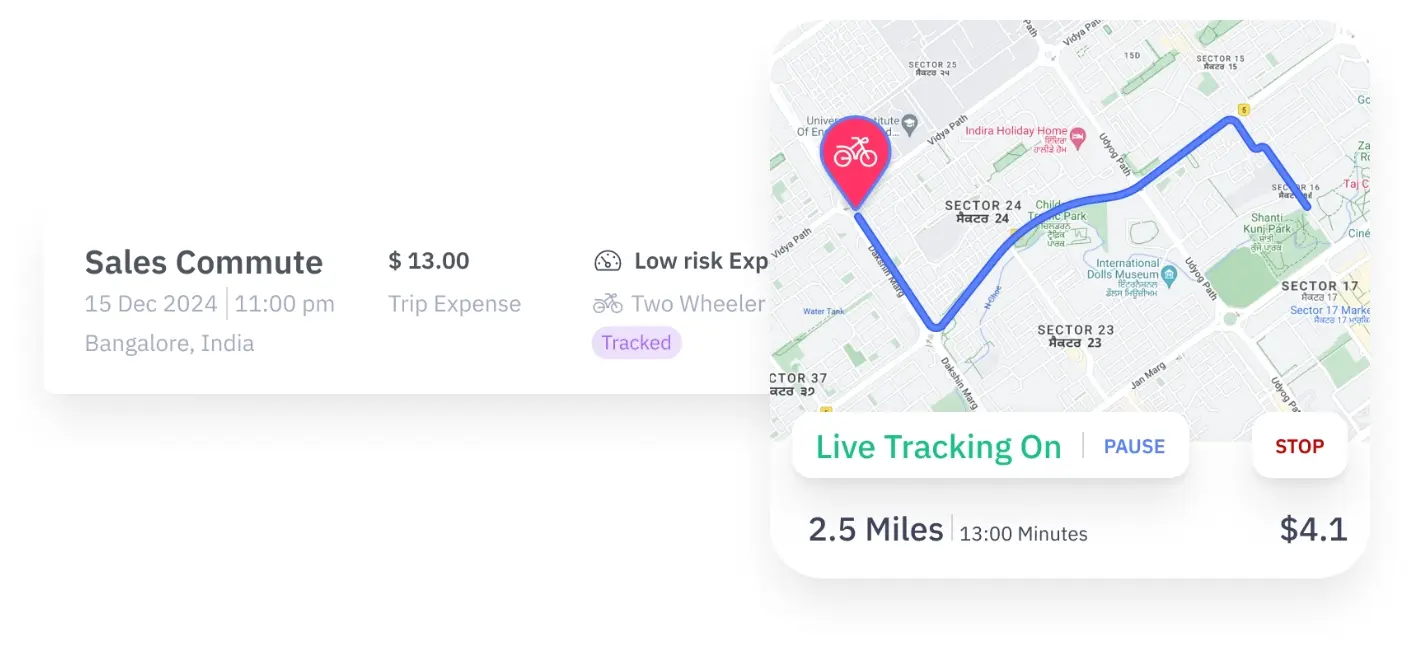

Mileage/Trip Meters

Leveraging GPS tracking and data from smart wearables, we enabled automatic tracking and filing of mileage and per diem expenses, streamlining the process for users.

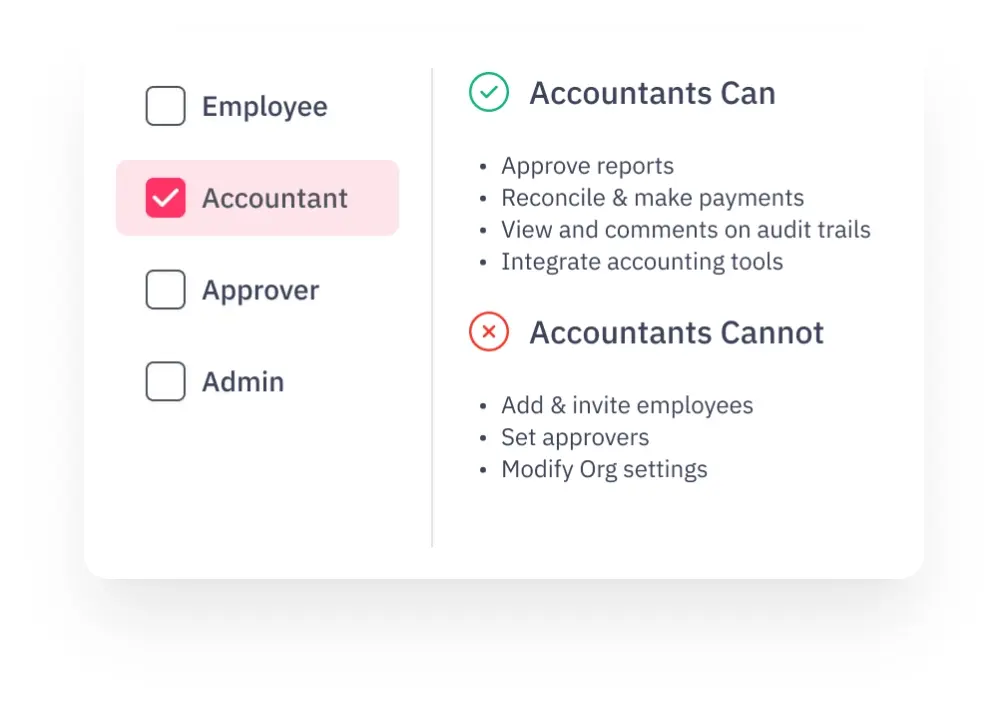

User Permissions

We designed customized dashboards tailored to the specific access levels and functional priorities of each role, ensuring users received the most relevant information and tools for their tasks.

Multi-Org Setup

We enabled users to link multiple organizations to a single Fyle account, allowing for separate accounting processes while facilitating unified auditing across all organizations.

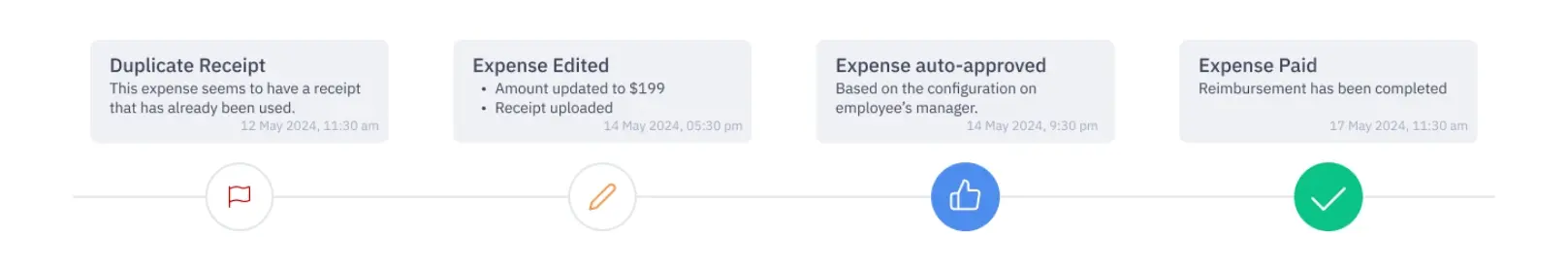

Audit Trails

We implemented audit trails to track all changes and discussions related to each expense, ensuring transparency and accountability throughout the process.

Designers Leading Product Management: From Feature to Break-Even

Transitioning from a pre-funding feature to a break-even product was a major challenge. With designers also handling product management, we navigated multiple pivots, funding rounds, and grew from a 12-member team to 80 members, including 9 designers. By optimizing for each persona based on ROI, we achieved our first million in revenue in just under two years.